arkansas estate tax return

Other Arkansas credits include the political contribution credit of up to 50 per year. 8939 historical form only Department of the.

6 7 Million Arkansas Mansion Has Its Own 1 2 Mile Race Track

The statewide rate is 65.

. You can go back to preparing your own tax return next year. AR1000CRV Composite Income Tax Payment Voucher. Income Tax Return for Estates and Trusts.

The 2017 tax reform law raised the federal estate tax exemption considerably. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally resolved. AR1055-CR Composite Extension of Time to File Request.

The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. Instructions for Composite Tax Return. Mobile gaming revenues from the King division and titles such as Call of Duty.

Hi Michele with that kind of capital gain you really need to speak with an accountant. This marginal tax rate means that. Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete Individual Partnership.

AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Credits. State Tax Forms. If you make 70000 a year living in the region of California USA you will be taxed 15111.

Get Copies and Transcripts of Your Tax Returns. Learn how to get each one. Complete sign CA Form 540 or Form 540NR and Schedule X- Print Mail the Form to CA Tax Department to.

The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual Partnership Fiduciary and Limited Liability Company tax codes and regulations. Similar to a Form 1040 on. Arkansas has some of the highest sales taxes in the country.

ABC News Linsey Davis spoke with attorney Isaac Wright Jr who was wrongfully convicted to life in prison about his book Marked for Life. You may need a copy or a transcript of a prior years tax return. AR1000F Full Year Resident Individual Income Tax Return.

When Are Taxes Due. Property taxes in the state are among the lowest in the US. Prescription Drugs are exempt from the Arkansas sales tax.

AR1002-TC Fiduciary Schedule of Tax Credits and Business Incentive Credits. Download your states tax forms and instructions for free. AR K-1 Arkansas Income Tax Owners Share of Income Deductions Credits Etc.

The transaction gives Microsoft a meaningful presence in mobile gaming. Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001 Tax Due Amendment Return. Your average tax rate is 1198 and your marginal tax rate is 22.

Arkansas does not tax Social Security retirement benefits. Overview of Arkansas Retirement Tax Friendliness. The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the.

To find a financial advisor who serves your area try our free online matching tool. It later turned around and repealed the tax again retroactively to January 1 2013. To find out the status of your refund youll need to contact your state tax agency or visit your states Department of Revenue website.

Get breaking news and the latest headlines on business entertainment politics world news tech sports videos and much more from AOL. In Arkansas the median property tax rate is 620 per 100000. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent. 17 is the due date for filing an extended tax.

AR1000-OD Organ Donor Donation. On the other hand sales taxes in Arkansas are quite high. Partnership Tax Return Instructions.

Gift taxes under the Code. AR1000TC Schedule of Tax Credits and Business Incentive Credits. Form 1041 is the US.

AR4FID Fiduciary Interest and Dividends. Mobile as well as ancillary revenue. Gift tax on certain transfers that are otherwise subject to US.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive. AR1000NR Part Year or Non-Resident Individual Income Tax Return.

An exemption from gift tax under a treaty is made on a gift tax return. Tara writes and lectures frequently on issues affecting individuals with disabilities and their families. AR1050 Partnership Tax Return.

AR1000RC5 Individuals With Developmental Disabilites Certificate. They may charge you 500-1000 to prepare your return but theyll save you 5000 in taxes. For most years the deadline to submit your tax return and pay your tax bill is April 15.

Mail the following items to get an exact copy of a prior year tax return and attachments. The child care credit which is equal to 20 of the federal child care credit. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999.

And the credit for adoption expenses also 20 of the federal credit. Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12. Get a Copy of a Tax Return.

Fiduciary and Estate Income Tax Forms. Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915.

Individual Income Tax Return Form IT-201 Resident Income Tax Return Tax Year 2021 IT-201 Department of Taxation and Finance Resident Income Tax Return New York State New York City Yonkers MCTMT 2 1 For the full year January 1 2021 through December 31 2021 or fiscal year beginning. One Mans Fight for Justice From the Inside. She practices in the areas of Special Needs Planning Elder Law and Trust and Estate Planning and Administration.

These treaties may eliminate the US. Tennessee repealed its estate tax in. New Jersey phased out its estate tax in 2018.

AR1002NR Non-Resident Fiduciary Income Tax Return. The applicable treaty must be analyzed for application to the transfer. April 2017 - Vol.

AR1002F Fiduciary Income Tax Return. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. ARK-1 Arkansas Shareholder Partner or Beneficiarys Share of Income Deductions Credits etc.

The American Families Plan Taxes Billionaires And Protects Family Farms And Businesses Center For American Progress

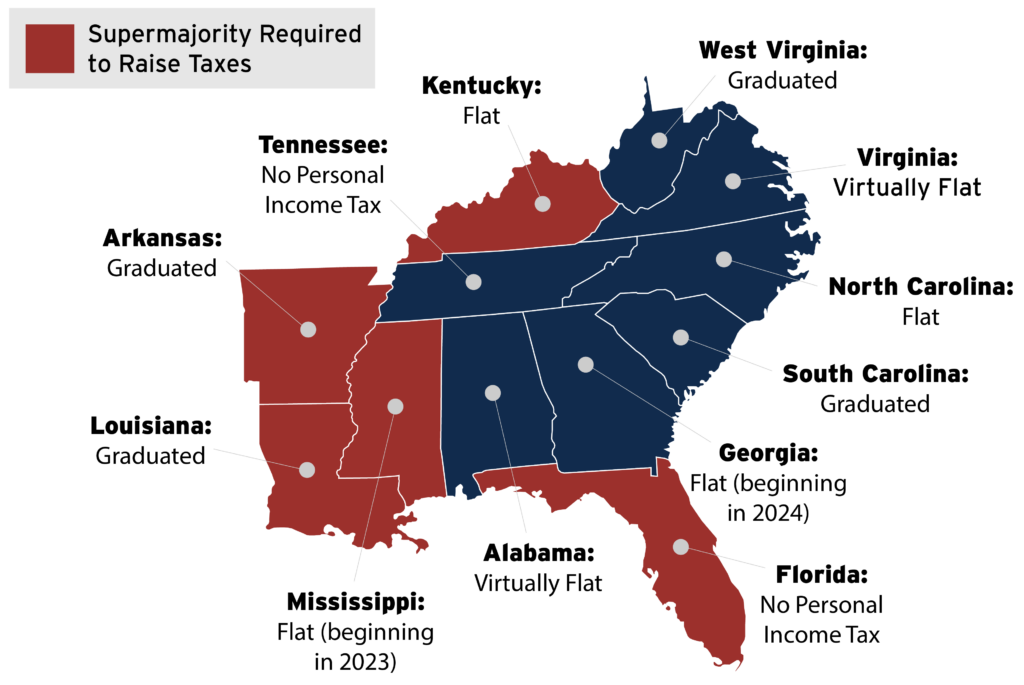

Creating Racially And Economically Equitable Tax Policy In The South Itep

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

State Estate And Inheritance Taxes Itep

Homestead Tax Credit Real Property Aacd

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Arkansas Collect Estate Or Inheritance Tax

Is There An Inheritance Tax In Arkansas

How Is Arkansas Probate Law Different

Historical Arkansas Tax Policy Information Ballotpedia

How Do State And Local Property Taxes Work Tax Policy Center

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Property Tax Calculator Estimator For Real Estate And Homes

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Free Arkansas Marital Settlement Divorce Agreement Word Pdf Eforms

Arkansas Lawmakers Enact Complicated Middle Class Tax Cut Tax Foundation

Massachusetts Resident Estate Tax Return Form M 706 Form M 706 Us Legal Forms